INVITATION TO BECOME A GOLD DEBIT MEMBER

IN CONVERTING A PART OF YOUR ASSETS INTO GOLD, ARCA WILL SUPPORT

YOUR IMMEDIATE LIFE PLANS INCLUDING 1) ASSET MANAGEMENT, 2) RISK MANAGEMENT, AND 3) INHERITANCE

WITH OUR RELIABLE SERVICES RANGING FROM THE PURCHASE, SALE, STORAGE OF GOLD WITH A HIGHLY REGARDED PRECIOUS METAL RETAILER IN SWITZERLAND TO THE ADMINISTRATION OF TRANSACTIONS AND ASSET MANAGEMENT ADVICE IN JAPAN.

SAFE AND SECURE IN SWITZERLAND

YOU CAN SAFELY AND SECURELY STORE THE GOLD IN A HIGHLY SECURE BANK SAFE IN SWITZERLAND LONG TERM SIMPLY BY REQUESTING THE SERVICE AT ARCA K.K. OR VIA THE MEMBER WEBSITE.

EXCELLENT COST PERFORMANCE

COSTS INCURRED IN THE PURCHASE AND MANAGEMENT OFGOLD ARE MORE THAN REASONABLE. FEES FOR STORAGE OF THE GOLD ARE VERY FAVORABLE.

EASY PURCHASE OR SALE OF GOLD

ONCE REGISTERED AS A LIMITED GOLD DEBIT MEMBER (NOT APPLICABLE TO A LEGAL "CRYPTO-CURRENCY" (VIRTUAL CURRENCY”)), YOU ARE ELIGIBLE TO PURCHASE OR SELL GOLD AT THE MEMBER-DEDICATED WEBSITE. GOLD TRANSACTIONS ARE FREE FROM JAPANESE CONSUMPTION TAX AS THEY ARE EXECUTED IN SWITZERLAND. ACTUAL GOLD CAN ALSO BE OBTAINED IN JAPAN BUT JAPANESE CONSUMPTION TAX MUST BE PAID. INCOME TAXES APPLY TO GOLD INGOT TRANSACTIONS. PROFIT/LOSS FROM TRANSACTIONS DOES NOT FALL ON CRYPTO-ASSETS AND IS TAXED AS CAPITAL GAINS INCOME AS PART OF AGGREGATED TAXATION.

BENEFITS OF GOLD DEBIT

THERE ARE A NUMBER OF BENEFITS OF GOLD DEBIT INCLUDING

COUNTER-MEASURE AGAINST DEPOSIT INSURANCE CAP

THE MAXIMUM AMOUNT OF DEPOSIT PROTECTION AT A BANK IN JAPAN IS 10,000,000 YEN. GOLD DEBIT DEPOSITS GOLD ITSELF AT A BANK AND IS EFFECTIVE AS A COUNTER-MEASURE AGAINST THE DEPOSIT INSURANCE CAP THROUGH DAMAGE INSURANCE

SAFE STORAGE IN SWITZERLAND

YOUR GOLD IS STORED IN A HIGH SECURITY SAFE AS A SPECIFIC DEPOSIT AND RECORDED UNDER YOUR NAME AT A BANK IN SWITZERLAND.

SECURE CONCIERGE DESK

YOUR ACCOUNT AND INDIVIDUAL INFORMATION IS TREATED SECURELY VIA AN ELECTRONIC LEDGER MANAGEMENT COMMONLY USED BY PROFESSIONAL ACCOUNTING FIRMS. THE SYSTEM IS KEPT COMPLETELY SEPARATE FROM THE INTERNET AND OPERATED BY A LIMITED NUMBER OF EMPLOYEES AT THE CONCIERGE DESK.

FREE FROM JAPANESE CONSUMPTION TAX

GOLD PURCHASED, STORED AND SOLD IN SWITZERLAND IS FREE FROM JAPANESE CONSUMPTION TAX. IN THE CASE WHERE YOU RECEIVE THE GOLD IN JAPAN, A 10% CONSUMPTION TAX IS LEVIED. IF YOU SELL THE GOLD IN JAPAN, 10% CONSUMPTION TAX IS ALSO LEVIED. PROFITS FROM THE SALE OF GOLD WILL BE SUBJECT TO INDIVIDUAL INCOME TAX (CAPITAL GAIN INCOME TAX, AGGREGATED TAXATION). THE TAX RATE FALLS FOR THE SALE OF GOLD AFTER 5-YEARS OR MORE IN POSSESSION). IN THE CASE OF A CORPORATE INVESTOR, NO CONSUMPTION TAX IS LEVIED EXCEPT WHEN THE GOLD IS IMPORTED INTO JAPAN. CORPORATE INCOME TAX IS LEVIED.

AFFORDABLE MONTHLY DEPOSIT PLAN

THE MINIMUM SUBSCRIPTION AMOUNT IS 10,000,000 YEN. YOU CAN CHOOSE AN AUTOMATIC DEPOSIT PLAN OF A MINIMUM OF 1,000,000 YEN A MONTH.

SAFETY IN GOLD DEBIT

SAFETY IN GOLD

GOLD IS A "REAL ASSET" WHICH CANNOT VANISH OR ROT. IT MAINTAINS ITS VALUE AND, UNLIKE EQUITIES AND BONDS, IS FREE FROM CREDIT RISKS. FURTHER, IT IS NOT VULNERABLE TO POLITICAL AND ECONOMIC INSTABILITY. AS A RESULT, THE VALUE OF GOLD NEVER DROPS TO ZERO.

SAFETY IN GOLD DEBIT

THE INGOT (REAL GOLD) YOU PURCHASE AT GOLD DEBIT IS PROCURED FROM "PRECINOX" IN SWITZERLAND. PRECINOX IS A GOOD DELIVERY BAR AUTHORIZED BY THE "LBMA" (LONDON BULLION MARKET ASSOCIATION) AND IS THE THIRD LARGEST GOLD REFINER IN SWITZERLAND. THEIR GOLD DEPOSITS ARE PROTECTED BY TRIPLE OR QUARDRUPLE LAYERED SECURITY AND ONLY AUTHORIZED PERSONNEL CAN ENTER THE GOLD STORAGE AREA. GOLD DEBIT IS A NEW TYPE OF SYSTEM IN WHICH YOU HOLD REAL GOLD REMOTELY IN SWITZERLAND.

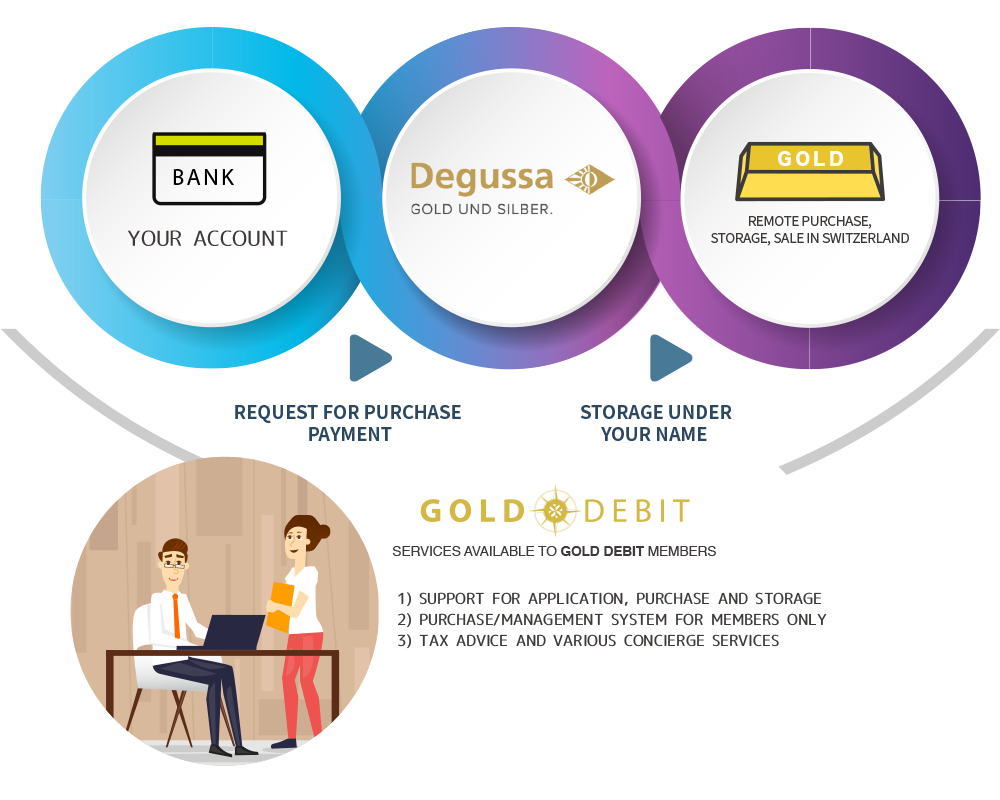

GOLD DEBIT STRUCTURE

| ※ | THE PURCHASE/MANAGEMENT SYSTEM FOR GOLD DEBIT MEMBERS INCLUDES FULL ITEMIZED TRANSACTIONS AND GOLD PURCHASE HISTORY. |

|---|

FREQUENTLY ASKED QUESTIONS

-

CAN A CORPORATION BE A MEMBER?

YES. A CORPORATION CAN BE A GOLD DEBIT MEMBER PROVIDED IT MEETS CERTAIN CONDITIONS SUCH AS HAVING AN OFFICE IN JAPAN. PLEASE FEEL FREE TO ASK FOR MORE DETAILS.

-

HOW IS GOLD DEBIT TREATED FROM A TAX VIEW POINT?

<CONSUMPTION TAX>

PURCHASE/SALE OF GOLD AT GOLD DEBIT IS FREE FROM JAPANESE CONSUMPTION TAX BECAUSE THE GOLD IS PURCHASED/SOLD IN SWITZERLAND. THIS MEANS IT IS NEVER IMPORTED INTO JAPAN. IF YOU WISH TO BRING THE GOLD ITSELF INTO JAPAN, A JAPANESE CONSUMPTION TAX IS LEVIED.

<INCOME TAX>

PINCOME FROM THE PURCHASE/SALE OF GOLD FALLS UNDER CAPITAL GAINS INCOME UNDER INCOME TAX LAW IN JAPAN. YOU NEED TO FILE A TAX RETURN IF YOU HAVE AGGREGATED TAXABLE INCOME TOGETHER WITH OTHER INCOME. IF YOU MAKE GOLD DEBIT TRANSACTIONS AT LEAST ONCE A YEAR, YOU WILL RECEIVE A YEARLY REPORT IN JANUARY OF THE FOLLOWING YEAR.

ENVISAGE ASSET MANAGEMENT WITH GOLD - - - UNIVERSAL VALUE